Senior Tax Accountant Resume. These projects may relate to internal operations and/or funds for which we provide services to. Senior Tax Accountants oversee a team of tax accountants who assist clients with their financial and income tax statements.

Tax Accountant Resume. by Aspirations Resume.

What Does a Senior Accountant Do.

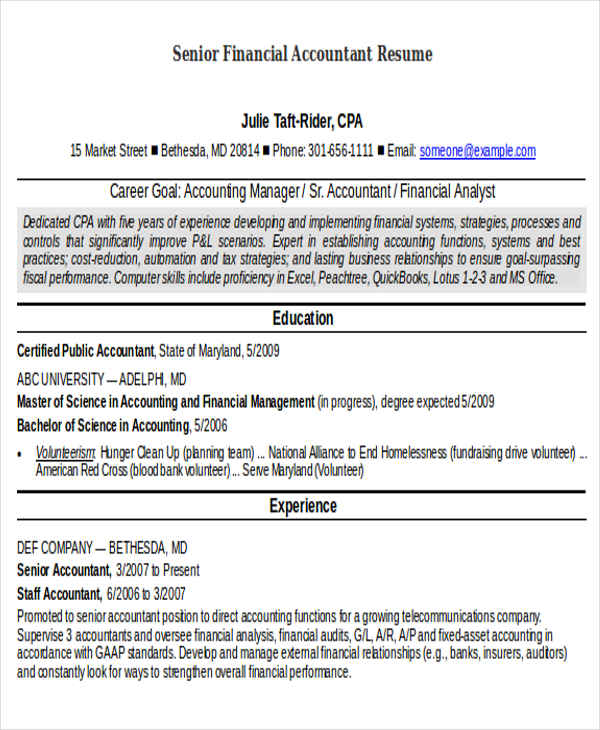

A well-written and attractive resume is vital to your job search Completed rigorous mentoring program with one-on-one training from senior accountants, tax Does the senior accountant resume sample indicate the candidate's ability to prepare financial records. There are certain skills that many senior accountants have in order to Other degrees that we often see on senior accountant resumes include associate degree degrees or diploma degrees. Senior Accountant skills and qualifications may include degrees and certifications, previous work experience, technical skills, soft skills and personality traits compatible with working with Strong understanding of federal, state and local tax regulations.